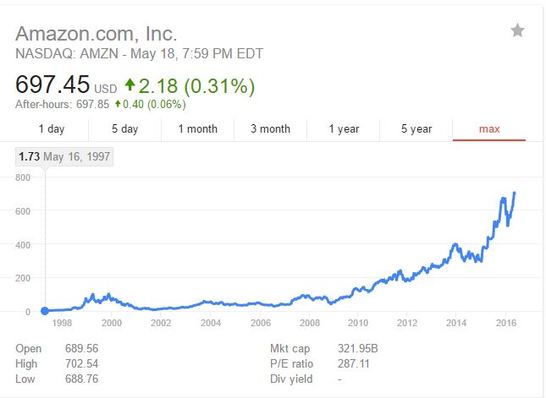

This post is part of a 4-article series (this being 3/4) where we understand the businesses of two tech giants who have revolutionized our lives: Facebook and Amazon. As we understand and analyze their mission, business model, leadership style, and valuations - we will reach a conclusion to which side investors should take. This post focuses on understanding Amazon's business model and how to value it. - - - - - - - - - As Amazon’s founder (later profiled in the article) has been the CEO for 2 decades now, and has led the company with a singular and steadfast mission, understanding the company’s roots and history will tell us a lot about its priorities. Let’s take a quick overview of the journey, before getting to its current state of business and valuations, which are discussed in later sections: Amazon.com was launched in 1995 and as an online catalog for books. It started small with a focus on selection, price, convenience, and reliable fulfillment. The focus continued to be front and center of the e-tailer’s philosophy, as it slowly ventured into newer market segments and geographies. Buyer’s convenience was not the only differentiator though. One thing the company did very differently from most retailers (non-tech) was the way it managed its cash flow philosophy, which was dictated by its long term vision: the company all the way acted (spent) like the entity it wished to grow into. It thus continued to invest its operating cash flow back into expanding its facilities. The philosophy of taking a net loss on the bottom line to scale up operations really worked, especially with the bursting of dot com bubble in its growth journey - In the aftermath of which, large “.com investments” were frowned upon by investors, and many start ups that could've once been a competition to Amazon, were forced to lock their e-stores down. Other large retailers (who were planning to go set up e-stores) now turned wary about the prospects of going big online. Meanwhile, Jeff Bezos (Founder & CEO, Amazon) relentlessly continued to invest and scale up operations that were too difficult to imitate by the time world realized the macro shift towards online retail. It was too late by then and the 'mall-to-Amazon' shift was in full speed, even through the recession, making Amazon undoubtedly the world's largest e-tailer (ex-China). As of today, in addition to retaining that position, it is gushing along at ~20% compounded annual growth, and single handedly calling the demise of mall-retail. In this process, it has created tremendous wealth for its share holders (If you invested $10,000 in Amazon's IPO in 1997 and held the shares, they'd be worth ~$4.67 Million today). Alongside conducting the mainstream e-tailing business, Bezos also kept coming up with ideas of converting their core skills/needs into a service so good that Amazon could be in the business of offering them to other businesses: Two main businesses have come out of this: One on consumer side (B2C) and other B2B. First being the electronic consumer unit, which is well known by its line of Kindle & Fire devices, and other being Amazon Web services (AWS) - offering computing services to other companies. While the consumer electronic numbers are still not available, we now know what AWS has turned into: Amazon's profit generating unit. Before we cover up this quick summary, it is crucial to note that these two by itself do not cover the industries Amazon might be competing in. The company is investing heavily in many sectors, and it will be only a surprise by the time we realize that it owns a new category. For example, it is going against Apple (through e-readers and tablets), Google (through Amazon Echo), Netflix (through Amazon Prime video), Youtube (through Amazon Video direct, and Twitch), grocery stores (through Amazon fresh), consumer goods companies (through Amazon Basics, Happy Belly, Mama Bear) and delivery (through innovating transport), to name a few. It might not be a leader in each one of these, but none of these are currently priced in as a success and surprise risk is only to the upside. The beauty also is that none of the divisions were carved out to make up for the core's slowdown (as is often the case). The divisions have kept growing faster independently, while the core product got stronger through the Prime program, which I consider revolutionary: In layman’s terms, through the Prime program, Amazon wants you to be the online version of Costco. Costco charges you a membership fee, but it rewards you with exceptional deals in return so that it can make sure every time you need something, you go buy it from a Costco, and not think of going to Walmart or Target. Similarly, Amazon started piling rewards for the Prime program. In addition to unlimited free shipping, now it also offers streaming and music services for free as well - all together for $99 a year (A subscription to Netflix & Apple Music alone costs you ~$20/month). The vision is that as Amazon becomes the default method of buying anything online, eventually everyone on Earth using internet and buying products will have to be a Prime customer. It continues to believe in offering them the best deals, taking losses to enable further scaling up of business, while it is working on various programs (drones,sea-freight,etc) to try to figure out how can the industry reduce shipping costs. Even if they’re not able to figure that out, the growing Prime base will give them a huge recurring revenue stream and pricing power to go against. In layman’s terms, through the Prime program, Amazon wants you to be the online version of Costco. Costco charges you a membership fee, but it rewards you with exceptional deals in return so that it can make sure every time you need something, you go buy it from a Costco, and not think of going to Walmart or Target. Similarly, Amazon started piling rewards for the Prime program. In addition to unlimited free shipping, now it also offers streaming and music services for free as well - all together for $99 a year (A subscription to Netflix & Apple Music alone costs you ~$20/month). The vision is that as Amazon becomes the default method of buying anything online, eventually everyone on Earth using internet and buying products will have to be a Prime customer. It continues to believe in offering them the best deals, taking losses to enable further scaling up of business, while it is working on various programs (drones,sea-freight,etc) to try to figure out how can the industry reduce shipping costs. Even if they’re not able to figure that out, the growing Prime base will give them a huge recurring revenue stream and pricing power to go against. How to value this tricky business: From the stand point of valuing it as a business model, it still should largely be valued as an online retailer from revenue basis (93% of total revenues). (Things change when we judge it by bottom line, and we'll discuss why later). Now, online retailing by itself isn't a very lucrative business due to massive fulfillment costs, especially if you offer lowest prices on the market. Quick Question: If you're providing the lowest list-price online, is it still the lowest price for the consumer if he has to pay for the shipping? Quick Answer: No. To still make online buying lucrative, Amazon offers steepest discounts on shipping that are on the market (Amazon lost $5B in 2015 covering up for the shipping costs and not charging the user). In long run, the only way an e-tailer can control fulfillment costs enough to offer best value to consumers (including shipping) is: 'possessing scale'. If even at Amazon's scale, it has to take $5 loss on shipping a product worth $100, you can imagine how thin are the margins out there and no wonder why there aren't enough successful e-tailing competitors. All in all, it's a very low margin business with high fixed costs, and not lucrative until you possess a scale where benefits of scale start outweighing the capital requirements. Till then, any rational investor ideally will not select e-tailing as their first choice of business model to invest in. However, things might be different some years from now. Amazon.com in some years could be a recurring sales business model with prime membership revenues going straight to bottom line, while they also start to make money on sales banking on the scale of operations. It would also be a goliath in e-tailing and barriers of entry would be extremely high due to their scale effects on fulfillment capacity, supplier agreements, and sealed memberships. This profitability will come with a solid moat and blessed with pricing power. Now, that is a business model you wouldn't want to miss. Apart from retail services, AWS is a cloud services play in which Amazon has been investing for years now to build up necessary infrastructure. It has managed to beat Google and Microsoft in the cloud race, as they’re trying to play catch up on their own turfs (small business, and enterprise, respectively). Now that it has started to bear fruits, we can see how high margin a business that is. However, I think the tremendous pace of growth of the cloud services marketplace will attract more competition (and investment) and the sector might become fiercely competitive in times to come. By that measure, I wouldn't like to bank on continued increases in AWS margins that the street is currently projecting. I do believe though that Amazon will use the same strategy here, as it did on the e-tail side: Establish client relations and scale at lesser margins to be the dominant player that competitors (primarily Microsoft and Google) wouldn't be able to catch up with. However, due to accelerated growth, recurring stream and high margins - we would still assign a much better valuation to AWS, than its e-tail/commerce business (Will discuss exactly how much, in my next article). One last point I would like to bring to notice, while valuing these business models is that both models (Core & AWS) have tremendous tailwinds going for them. Move from brick-and-mortar to online shopping is strong enough to be labeled a generational shift and it will continue to push online sales up even in tougher times. At the same time, move towards cloud computing and omni-channel retail (Amazon provides AWS services to other retailers) has just started and has years, (if not decades) of accelerated growth ahead of us. Business models who are designed to benefit from sustainable generational macro tailwinds vehemently deserve market leading premium multiples. There you have it. Amazon's business model, how they make money and how to value it. Whether you are a user, parent of users, employee, or an investor - share with us your perspective (in comments) on "What do you think of Amazon- it's business and it's future?" No single person is ever right, but we collectively - often are. For the next blog in the series, we will do a deep dive analysis into Amazon's current valuations. If you're interested to be the first to know when it gets published, subscribe here. |

Brave BullTells you what the Mr. Market is missing. Archives

January 2022

Categories |

RSS Feed

RSS Feed