|

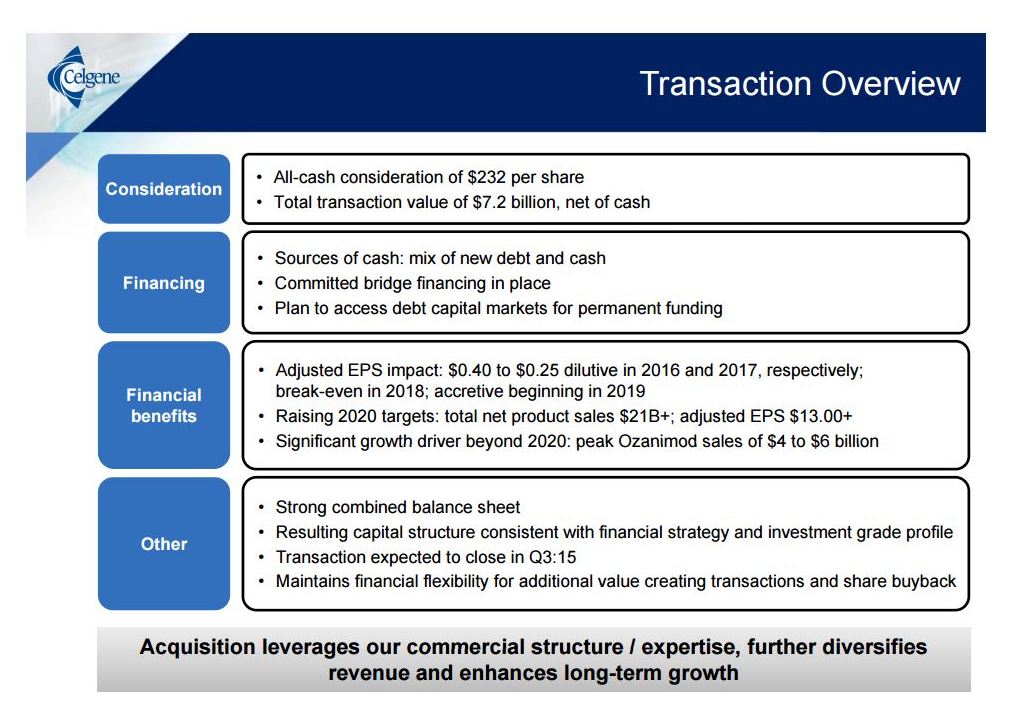

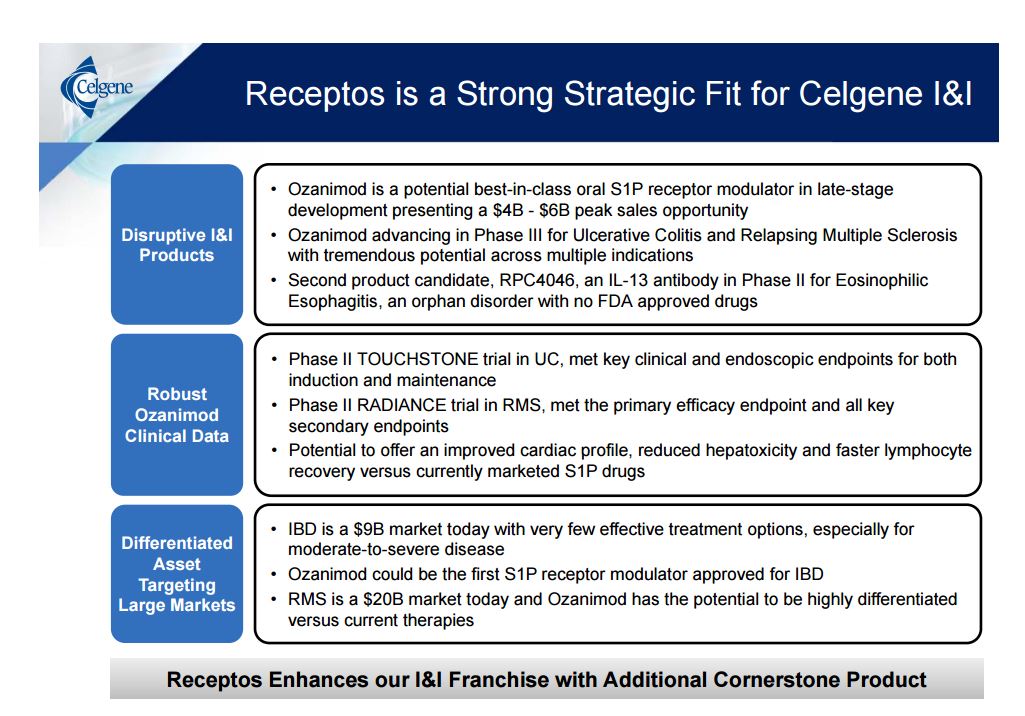

On March 20th 2015, I shared my 2 best picks (and largest positions) in the biotech sector (1 in large cap & 1 in speculative): i.e. Celgene & Receptos. Link: https://goo.gl/6rl5da Yesterday CELG bought out RCPT for a price that I’d call is ‘throw-away cheap’. CELG is up almost 9% today and RCPT is up ~50% from when I recommended. If you missed it, CELG also announced its preliminary Q2 results, with a beat on both top & bottom line; along with raising its full year guidance. At hardly 21-22x forward P/E (with persistent 25% growth - comes with similar top line growth) and with new potential billion dollar drugs in late stage trials, we bought some more at 132 today. With our 2015 end target of $158, I’d say..add on! Caching! P.S.: As always, you can get our real time alerts on our moves by subscribing at: http://goo.gl/thTtvo Select slides from Celgene's presentation:

1. Markets were worried about Fed.

2. Markets were worrying about Greece. 3. Markets were worried about Puerto Rico. 4. And hey, China came in calling! What is Mr. Market Missing: The fall in Shanghai composite & Shenzhen has a hidden positive for the U.S. Stock markets. Wondering how? Let's all agree that Europe worries are a temporary sentiment-changer and Chinese economy doesn't affect all US stocks. Also with the Chinese correction having more to do with the stocks correcting rather than a recession appearing, What is central to our markets is the Fed and interest rates. The fall in Chinese markets have created an environment of Chinese economy slowing down. This has led to a sharp decline in commodity prices (Hey, that's why Alcoa is battling to stay in double digits!), including the second leg of oil slump. While the Chinese local economy is only "slowing down" and government is fully committed, hopefully Chinese economy would do alright. However, the global fear of demand will push commodities down..suppress inflation further..and guess who'll take a breather? Fed. And with it, all of us. Caching. |

Brave BullTells you what the Mr. Market is missing. Archives

January 2022

Categories |

RSS Feed

RSS Feed