This blog post is compilation of LinkedIn posts that appeared in the months of April – June, 2017. Themes discussed are: April:

May:

June:

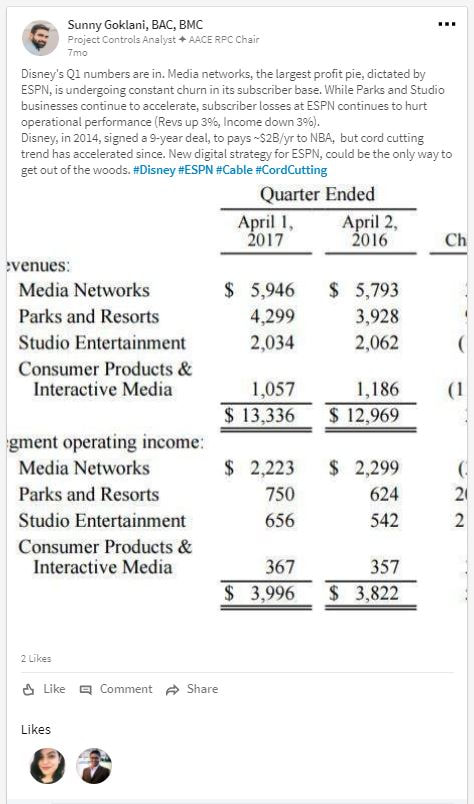

Posts Below : Clicking on pictures will take you to original posts on LinkedIn April 2017:

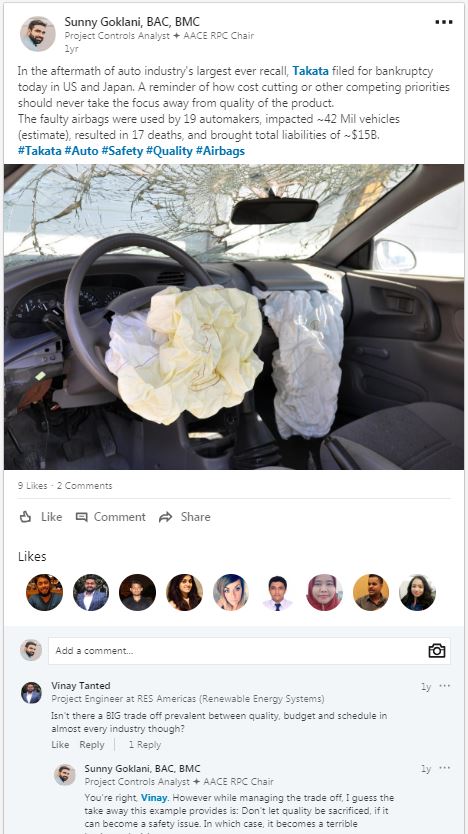

May 2017:

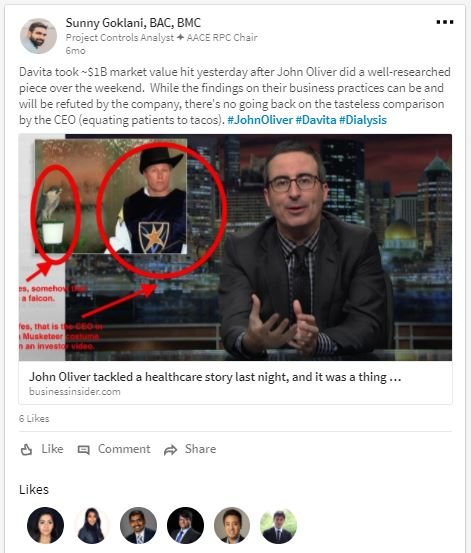

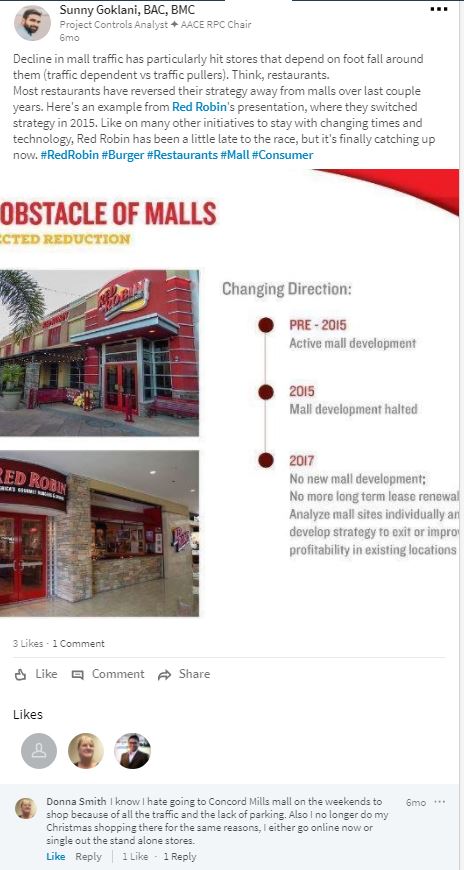

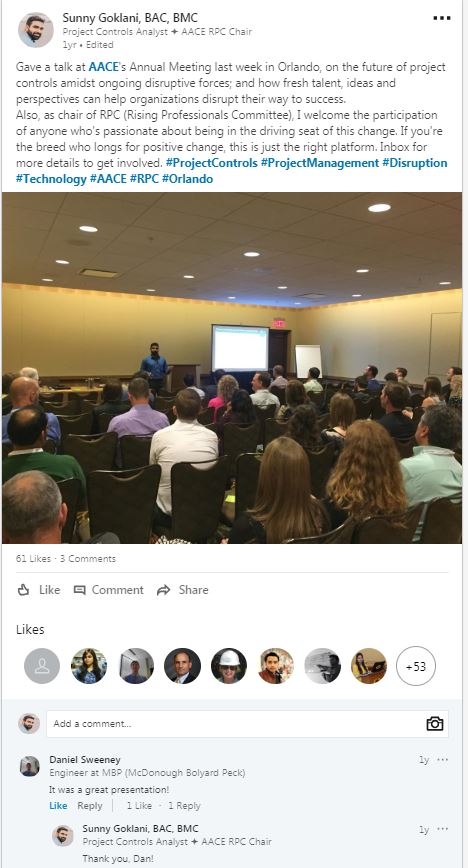

June 2017:

|

Brave BullTells you what the Mr. Market is missing. Archives

January 2022

Categories |

RSS Feed

RSS Feed