|

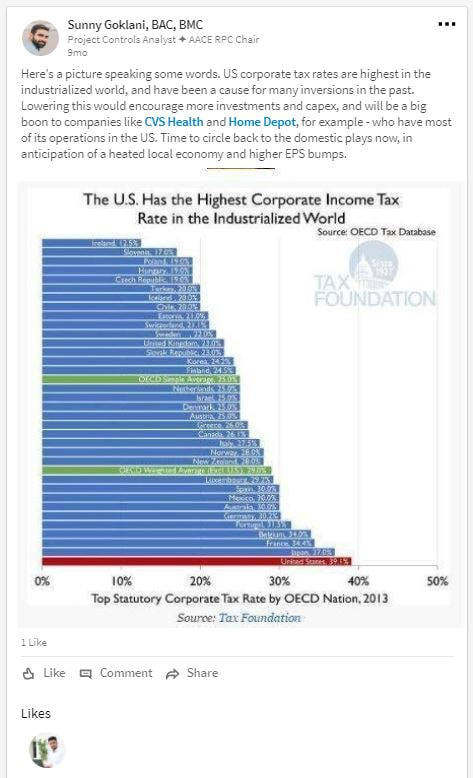

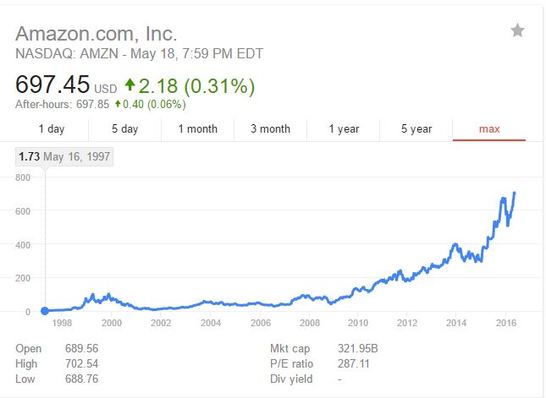

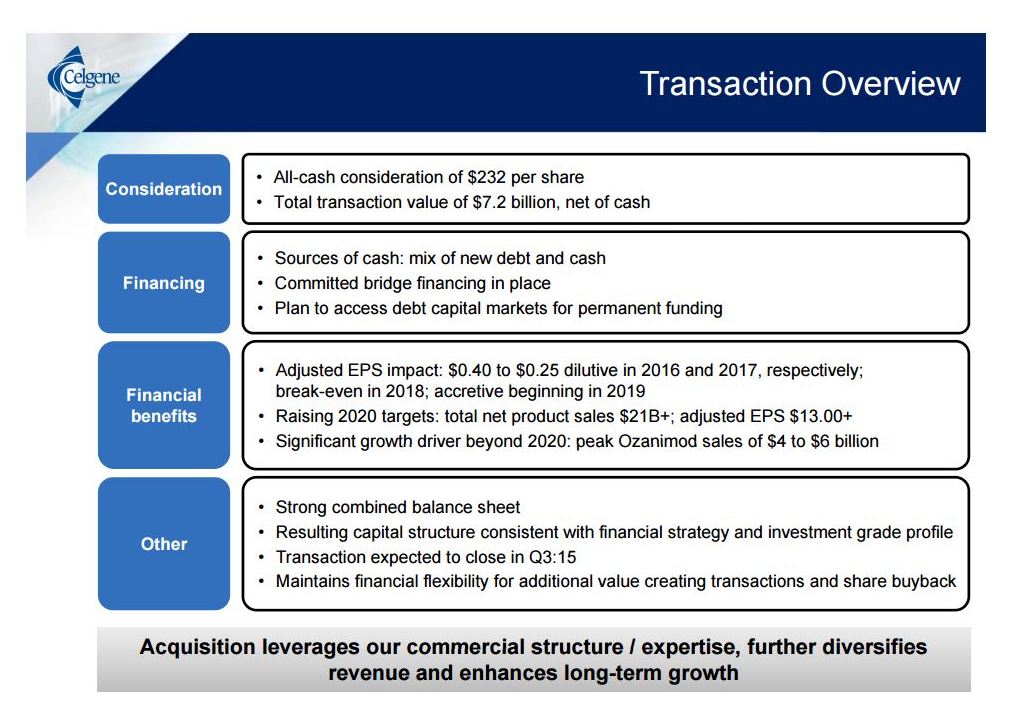

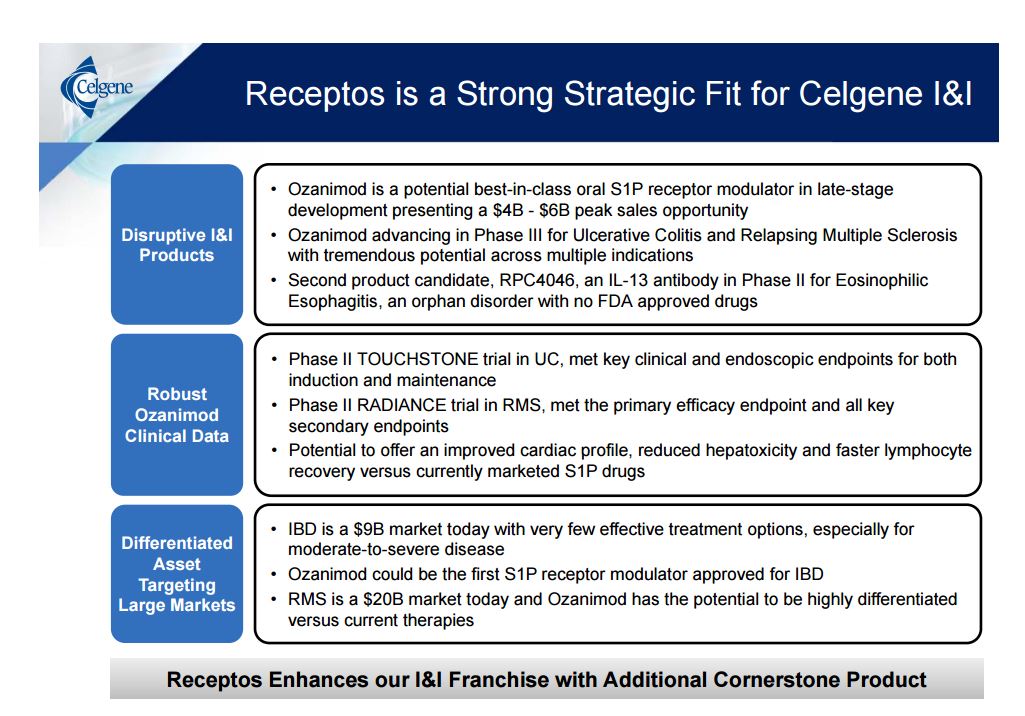

2021 was the first year when I officially published my Top-10 picks. I will shortly publish a podcast episode recapping our performance, wins, losses, and takeaways. With all the caveats previously mentioned in place (calendar shouldn't dictate what you invest in, this may not fit your individual investment needs, this isn't financial advice, etc.), this post covers my 2022 picks. Would love for you to follow along, join the journey, and invest with me. Let's get right into it: The 2022 PortfolioTracking:As this is published before the first trading day of 2021, you can mimic the investments above and join along. The sheet models the equal-weighted ETF with a $10,000 investment. Rationale1. Large Cap Growth: When venturing out of index funds, I always recommend starting with large cap growth: blue chips who have made it big and have proven themselves, but still have business momentum and tons of room to grow. Amazon: Since the CEO change (Bezos > Jassy), we've seen investments pick up - which has pressured Amazon's earnings and estimates (FY 2022 EPS consensus estimate has dropped to $51 from $66 over last 90 days). The stock barely ticked up (up 2.4%) in 2021 vs S&P's 27%. With significant recent underperformance and a lot of room to grow into, Amazon carries itself forward to another yearly ETF portfolio of mine. Current investment cycle will reap returns soon - hope it happens in 2022. Risk I'm looking out for: Continued deceleration in earnings as management may continue to invest towards long term supply chain and fulfillment initiatives Alphabet: is usually an easy stock to recommend, but it was a bit difficult to pick this after a 60+% return in 2021. The multiple is cheap vs where it could be, but is fair when compared to historical ranges. At ~25x forward p/e, I'm not picking this name solely for multiple expansion, but rather am betting on earnings momentum to continue. The company has beaten its estimates ('earnings surprise') by 19-65% over the last 4 quarters. If this momentum continues (with continued reopening and ad spend), the 2022 earnings estimates (3.6% YoY earnings growth) maybe on the lower end. If we get a couple more beats with increasingly shareholder friendly capital allocation/return (they're already on the right path), we may see the stock headed well above $2T Market cap in 2022. Risk I'm looking out for: Failure to commercialize 'other bets' I was debating adding Meta (FB) instead, as usually that's my style when I select yearly picks: i.e. give me something that has a lot of potential, but also has recently underperformed, is an underdog, and has compressed valuations. Meta is cheaper (~23x forward eps), unloved by the street, and has optionality opening up (with Oculus and Metaverse). It might be more volatile though: metaverse investments may go on for a decade, but we don't know exactly when investors will get to reap benefits. While I support the direction, its difficult to forecast when the returns and extra multiple points will show up. Alphabet seems driven by EPS vs P/E expansion in near term, which seems a safer bet. HDFC Bank: We have some diversification (sector as well as geography) by adding HDFC Bank to the list. The Indian private banking giant has been on a tear for years, but has taken a breather since Covid, as loan growth has slowed and bad loans (NPAs) have gone up. Recent management change (Aditya Puri retiring as CEO) also coincided with the results, shaking up investor confidence in the management and strategy. With setbacks, both in business and stock price, the stock now trades at 20x forward p/e, which is reasonable and has room to grow as the SME (Small & Medium Enterprises) and retail sectors in India pick up steam again. Risk I'm looking out for: Rise in NPAs (Non Performing Assets, i.e. bad loans), together with slowing loan growth 2. Fairly priced Consumer Discretionary: Target: has impressed over last years, especially with its: i) omnichannel fulfilment, ii) smaller store formats, and iii) merchandizing (when was last time you walked into Target and just walked out with what you wanted?). Building on these fundamentals and many a competitors having to close in 2020, it had a phenomenal 2020 and 2021 (Sales are projected to be ~$106B this year vs ~$78B in 2019-20). However the growth next year is projected to slow (to 2.3% revenue growth) - in part due to supply chain shortages. With those concerns, the stock is now at a reasonable ~16x forward p/e (~$13 EPS projection, 1.5% dividend yield, 5% Debt/MCap) - which is a reasonable valuation for a great management team executing a great strategy. I hope they continue the execution and estimates are raised through the year, but relying on multiple expansion is also a decent bet. Risk I'm looking out for: supply chain shortages affecting merchandizing flexibility Best Buy: Very similar story. Big pandemic winner (Sales up to ~$52B projected this year vs $43B in 2019-20), followed by a forecasted contraction (sales actually forecasted to drop ~2% next year). Primary concern on top-line is that buyers made one-time purchases to adjust to working from home, and won't return again as purchases weren't repetitive in nature. Primary concern on bottom-line is the Total Tech program, which in short term is pressuring profits, and in long term - we still don't know whether it will work. Ironically, management's solution to bottom-line problem is addressing the top-line problem in long run by hoping to make revenues more predictable (recurring) and through services (where Amazon can't readily compete). I don't usually include names with falling revenues, but I like Best Buy's story (its transformation over the last 10 years) and do believe there's value in checking out gadgets in person and wanting advice from "geeks". The company has ~no debt, is trading at ~11x forward eps, and sports a 2.75% dividend yield. I'm intrigued and hoping for both, but at least banking on multiple expansion by 10-20% this year. Risk I'm looking out for: not-so-good execution on TotalTech Uber: Reopening story. We know by now that widespread lockdowns are ~out of question. If they happen, they would be targeted and limited to certain geographies. Broadly speaking though, 2022 could be a continued reopening story. While 2021 saw Uber struggling to keep costs in control again (driven by labor shortages and rising wages), 2022 might provide stability. Also with Uber being Top 1 or 2 in most markets, I believe it will retain pricing flexibility. Revenue is forecasted to jump 52% this year and 48% next year, however the price will be very sensitive to profitability projections. Company is still losing money on bottom line and a 2022 turn around may push the stock price higher. Risk I'm looking out for: continued push in profitability, rising costs I closely considered adding LYFT instead of UBER, which I also think is a good buy. LYFT has advantages of: i) being local (US has lesser possibility of widespread shutdowns vs other global cities, I believe), ii) being focused (food delivery is not yet profitable for Uber), and iii) Lyft is supposed to be profitable this year, which should drive positive investor sentiment (Uber has pushed this goal farther a couple times). 3. Sector Focus: Financials & Healthcare Last 4 picks represent my sector picks for the year: financials and healthcare. In both sectors, we have 1 stable name and 1 leveraged ETF (which is risky, but can benefit returns if we turn out to be right). a. Financials Rising rates are the #1 story in every market forecast for 2022. Who does it benefit? Banks! (if yield curve flattening/inverting doesn't become a here-to-stay reality) Although the GDP growth is forecasted to slow in 2022 (to 3.8%), it remains above average, and should push loan growth higher. Who benefits? Banks! Also adding to the mix are: i) attractive valuations, ii) better capital-return programs, and iii) profitable businesses (not speculative growth). Together, I would hope valuations as well as earnings to head higher as the year progresses. Instead of picking a specific name, I've decided to go with ETFs (as I can't predict with certainty where most growth will come from - interest rates, loan growths, consumer spending, or M&A/advisory). FAS gives a 3x leverage to an ETF where large money center banks are major holdings. KRE gives exposure to a lot of regional banks. They both had a phenomenal 2021 (FAS with ~90% return, KRE ~25%), but valuations still look decent (performance was driven by earnings for the most part). Risk I'm looking out for: flattening yield curve, stagflation b. Healthcare Okay, we're addressing two very different animals here with our picks. XLV is dominated by big pharma (UNH, J&J, Pfizer, Abbvie, etc.), whereas LABU is 3x equal-weighted biotech - which covers a lot of small-mid-cap speculative names. CURE was our best pick last year. I still believe pharma will continue performing well in 2022 and the valuations still look decent. I wanted to keep the theme moving, but have reduced the leverage: going from CURE to XLV. Don't be in the impression that I was going to reduce the risk though, because here comes.. LABU: which is inherently very risky. I don't have a great reason to add it right here, right now; other than: I'm banking on mean reversion. Biotech has lagged the markets for a some years now, and while there are good reasons for it, we know the biggest policy fears have not come to fruition and there maybe upside here. I have gone with IBB (or BIB) to pick biotechs in past, but I don't like how now the biggest holdings (except Moderna, Regeneron) lack growth (think Gilead, Amgen, Biogen). IBB once used to be led by growth companies (Celgene, Regeneron, Vertex) - not anymore. So I've picked the 3x equal-weighted biotech. This can very well blow up (esp. in a rising rate environment, which is a decent possibility), but let's hope not. Risk I'm looking out for: speculative assets undergoing another round of devaluation due to a liquidity crunch Honorable MentionsThese are the 10 names I came close to adding, but they didn't make the final cut (and reasoning): 1. Meta (FB) - Should benefit from increased ad spending and Quest 2 success, but comes with near term uncertainty around RoI on Metaverse investments 2. Lyft (LYFT) - Should benefit from continued reopening and return to profitability, but Uber offered a better rebound (in growth) 3. Disney (DIS) - Should benefit from reopening (parks, movies), but don't have a way to establish a floor in valuations in case Disney+ subscription slows 4. SoFi (SOFI) - Continued execution and fairly valued here (at $15), but student loan (forgiveness) hangover remains in 2022 5. Robinhood (HOOD) - Valuation is attractive (at $18) with possible new crypto features to be announced, but too volatile and may swing with crypto prices. 6. WayFair (W) - Attractive below $200, but already have consumer discretionary exposure with Amazon, Target, and Best Buy 7. Energy - as a sector is the most favored on street for '22, but relative weight in S&P is insignificant - not missing out much in comparison 8. Ulta (ULTA) - I believe Ulta could be the ultimate reopening play with people getting ready to go out, but it trades at 22x forward eps, so stock performance will have to come from earnings - which is more uncertain of a bet. 9. Block (SQ) - Valuation is looking better now (at $160), but Afterpay acquisition ($29B!) needs to be digested. 10. CLOU - Cloud software plays have had a pullback, but may not perform well in a rising rate environment. ClosingOverall, I've tried to stay clear of high-momentum-no-earning speculative names, while also not going all-in on cyclicals (industrials, materials, energy). With Fed's recent change in stance, interest rate hikes are upon us. In this environment, names with better balance sheets and fair/reasonable valuations will do well. Accordingly, I've picked financials and healthcare as sectors to bank on. As for specific names, I've picked large cap growth companies who are at a reasonable valuation and have (in part, circular reasoning) subdued expectations in the near term (I have higher confidence in them being a great time to pick them in long term, but hopefully they'll work in short term too). Also unless the growth/consumer slows down, I'd suspect consumer discretionary/retail to do well with extended reopening. Target, Best Buy and Uber would capture some of that spending. I've added some risk too though: UBER isn't profitable, Best Buy's revenue is projected to decline, and LABU is highly speculative and can be this year's Alibaba (you don't want that) - but hopefully all are balanced risks, with opportunity to outperform. There are always risks. Best of Luck to us - Happy Investing! Let me know any/all of your thoughts/questions/concerns with this selection (in comments). If you liked this post/strategy, do share it with your friends. Disclaimers: 1. I am long all the stocks mentioned above as of 1/1/22 (except KRE), but am not paid by anyone to recommend these. 2. I am not a financial advisor. 3. Invest at your own risk (Do reach out for suggestion for substitutions/adjustments) --- Announcement 1: If you've been meaning to start fractional investing, options, or Crypto, here's a link to Robinhood. If you use this link, we will both get a free stock + I'll answer any questions you may have (on IG). Link: https://join.robinhood.com/sunnyg --- Announcement 2: I do #TipTuesdays on my Instagram on requests: where I address common theme of questions I'm getting on Tuesday evenings. Slide into my DMs with any and all questions. Handle: @thesunnypoint I had floated the idea of presenting 10 stocks for the new year, which fellow investors can invest in as an ETF equivalent (mimic by investing 1/10th in each). The response was overwhelming. As a result, with all caveats and reservations in mind, this blogpost is about my Top 10 picks for 2021. If you've been meaning to invest in individual stocks, but were not sure of where to begin, or needed some reasonable ideas, I hope this can provide a reference point (with fractional investing here, you can literally recreate this portfolio with as little as $10). Let's get through a couple obvious disclaimers and get right onto the portfolio: 1. Calendar investing isn't really a thing: We don't invest or change investment decisions, just because its a certain date on the calendar, or a certain position this planet happens to be on its orbit. So, let's keep that in mind. I'm picking companies that I'm comfortable to own for much longer than a year and the list just favors those that happen to be at what I think opportune entry points. There are companies outside of this list that I'm actually more bullish on for long term (e.g. Google and Facebook aren't on the list). 2. Fit: I have no idea what your specific risk tolerance is, or what your financial goals are. I would ideally suggest 10 different stocks to every individual investor based on their goals (and do comment/reach out to me with your situation and I'll get back to as many as I can with adjustments), but as a generic blog - this is my playground. Now without taking up any more of your time, let's get into it and see what're we playing with: The 2021 Portfolio:Tracking:As this is published before the first trading day of 2021, you can mimic the investments above and join along. Above models a conventional $10,000 figure invested. Rationale:---Those who follow me may already know my view on the markets and some of the companies mentioned above (Here's a Seeking Alpha article I wrote on the 2021 outlook). So, here's a 30,000' view of the rationale (and I can do a follow up post responding to all questions/requests) - 1. Value: I wanted to balance growth with value and hence the portfolio starts of with value names like Bristol Myers Squibb and Merck. Both have gone through a consolidation phase, have a good dividend yield, and sit at attractive valuations.

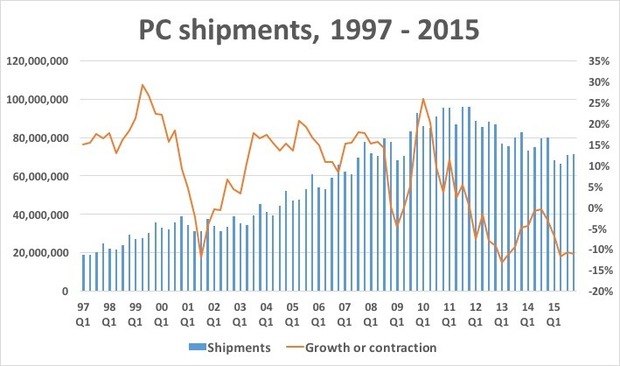

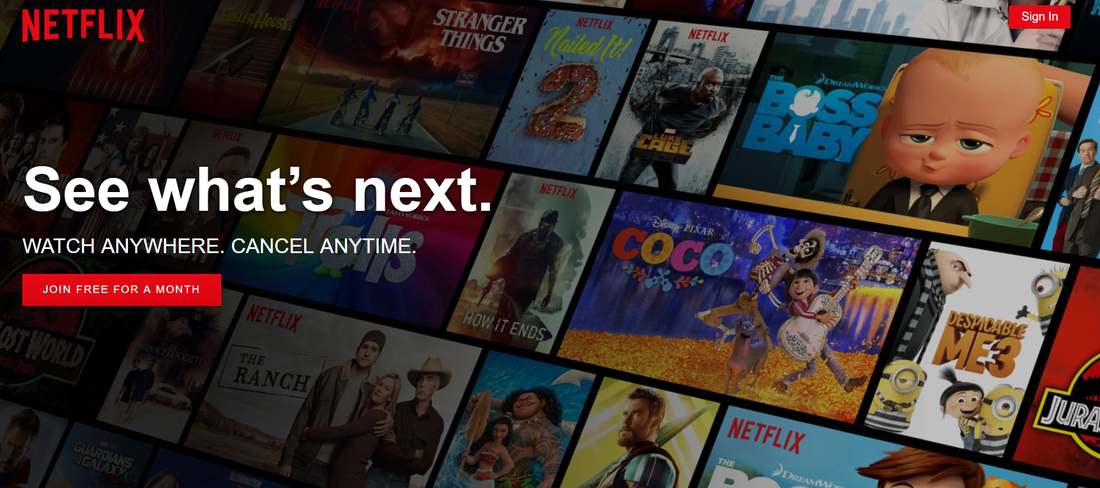

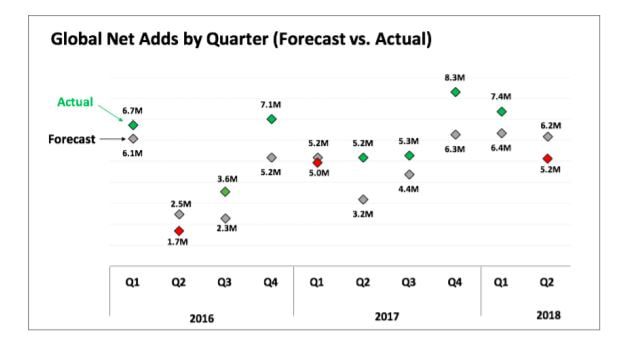

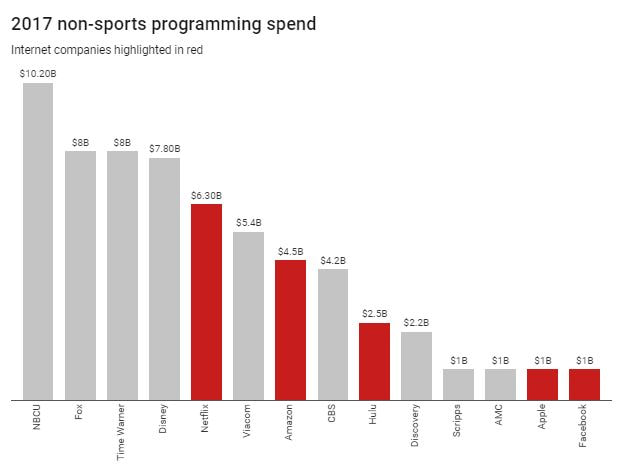

2. Growth: The hunt for profitable 20-30% revenue growers which had secular tailwinds for years to come - led me again to tech names. I filtered the list to those who have had a recent setback in price or have gone through a considerable consolidation phase. This led to me to: Alibaba, Amazon and Salesforce. Alibaba is undergoing antitrust scrutiny, Amazon forecasters fear harder comps in 2021, and Salesforce analysts are not giving Marc Benioff any benefit of doubt over Salesforce's acquisition of Slack. I see all of these being temporary. As these names go on to deliver great quarters and beat expectations (hopefully), sentiment could change.

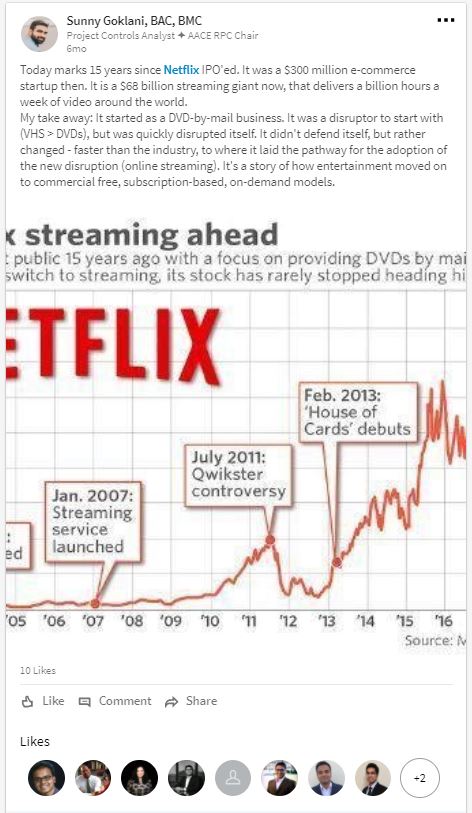

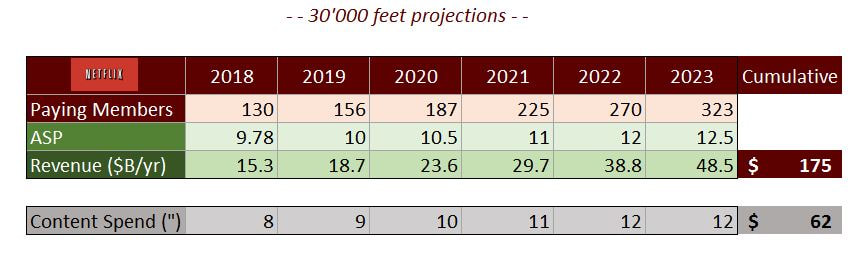

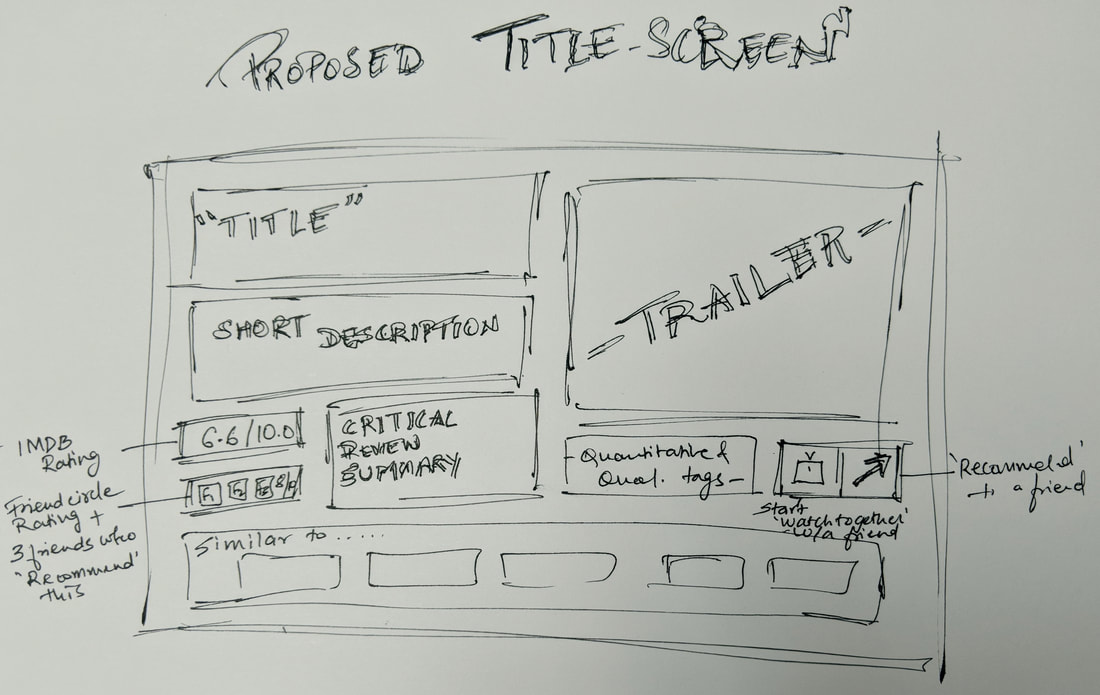

3. Risk: The last 3 names on the list add significant risk to the portfolio: a) Leveraged ETF: Readers maybe aware that I trade around leveraged ETFs and I thought it'll be only fitting to include one name here. If I had an option to add weightage, I'd allocate <1/10th to CURE, but in here it qualifies as a 1/10th holding, to keep things simple. While same time last year, I would've gone with either BIB (2x biotech), SOXL (3x semiconductors) or FNGU (3x FANG names); looking where we are now, Healthcare to me seems like a sector that hasn't participated much in the 2020 rally and major names in the XLV (CURE is 3x XLV) sit at reasonable valuation: JNJ, UNH, PFE, MRK, ABBV, etc. are major holdings. So let's roll the dice. b) SPACs: 2020 was the year of SPACs and quality of sponsors, for me, is the make-or-break criteria. Chamath Palihapitiya and Brad Gertsner are one of the smartest investors around. IPOF and AGC are their respective SPACs. These are also risky shot-in-the-dark options, as we don't know what they're gonna acquire yet, but if these work out well, they may offer significant edge to the portfolio. I believe we aren't that far into the SPAC craze to have exhausted good targets, and these two respected investors will carve out a niche investment in the fast growing tech space. 4. Balance: I wanted to diversify a bit into retail/housing and went with Lowe's which offers a decent GARP profile. Housing has been super strong in 2020 and people who have moved into suburbs or bought new houses, will continue to furnish/fix them. Lowe's saw unexpected growth in 2020, but I believe the turnaround which was already underway helped it perform better than the industry + new customers may continue to prefer Lowe's over the coming years. Adjusted for debt and yield, Lowe's currently trades at ~18x '22 EPS, which is fair - not cheap, but I'm banking on the continued turnaround for performance to beat expectations. I wrestled with: 1. Adding Wayfair (W) instead of LOW or CRM, but with other risk assets in the portfolio, thought a mix of LOW+CRM would be a more dependable choice. I do think Wayfair's ~$20B valuation is attractive though, if they continue being profitable in 2021. 2. Adding FB & GOOG - it would've led to high concentration among FANGs and I'd just mimic the S&P 500 heavyweights, which I resisted the urge to. I kept to adding 1 of the lot and did so for the name longest in current consolidation. Overall, I've resisted the strong urge to go big into reopening sectors. Yes, we know that the vaccine is here and things will go back to normal sometime in 2021- but easily forecastable sectors (restaurants, hotels, etc) have already rebounded, while those at discount are difficult to forecast (air travel and cruise lines, for example). Not looking at sectors, I've looked at individual names that are attractive at this point and those that I can understand. Somehow again, I've ended up with healthcare and tech. We have 4 healthcare names, 5 tech names in the portfolio (2 SPACs will most likely be tech) and 1 consumer/housing play. Let's hope things get back to normal ASAP, but.. we still beat the market with this portfolio :) Best of Luck to us - Happy Investing! Let me know any/all of your thoughts/questions/concerns with this selection. If you liked this post/strategy, do share it with your friends :) Disclaimers: 1. I am long all the stocks mentioned above, but am not paid by anyone to recommend these. 2. I am not a financial advisor. 3. Invest at your own risk (Do reach out for suggestion for substitutions/adjustments) --- Announcement 1: If you've been meaning to start fractional investing, here's a link to Robinhood. If you use this link, we will both get a free stock + I'll answer any questions you may have (on IG). Link: https://join.robinhood.com/sunnyg --- Announcement 2: I do #TipTuesdays on my Instagram where every Tuesday evening, I give out a stock tip/investing best practice. For a limited time, I'm also answering ALL DMs. Slide into my DMs with any and all questions. Handle: @thesunnypoint Last week, Netflix reported its Q2 ’18 earnings: Revenues grew by 40%, Net income more than quadrupled. The stock however lost its momentum and fell 15%. Why? The company missed on its subscriber additions: it added 5.15 Million subscribers, lower than 6.27 Million consensus and its own forecast of ~6.2 Million. Picture source: My logged out screen I’m not worried about the business though – not even a little bit. Estimating exact number of sign ups in a 90-day period is not only a tricky subject, but also a myopic view of the trend. Over the long haul and in the big picture, I see Netflix continuing to be the leading standalone streaming business in the world – one that continues to not only disrupt media and entertainment, but also our lifestyle. If you refer the picture below, it’s evident that over time, the forecasting cycle of being conservative-aggressive-conservative has balanced out in the Netflix’s favor, and even with 130 million subscribers worldwide, the company is still just getting started (in the developing world). I hope it’s clear by now that this piece is not intended to bash Netflix or its content. I love Netflix as a service and would like it to continue to succeed. Although one thing I am indeed worried about is whether ‘Content RoI’ can be sustained in this age of exploding content and whether Netflix can maintain its competitive edge. Netflix caused the Big-Bang in 2013 and the content universe has since continued to expand at an accelerated pace. The picture below shows how the Netflixes and Hulus of the world are spending more than ever and releasing content left and right. The amount Netflix spent in 2017, $6.3 Bil, was ~$5 Bil in 2016 and is slated to reach ~$8 Bil in 2018. What does this translate into? Roughly 1000 original projects in 2018 alone – yes, a THOUSAND original series and movies, and that’s Netflix alone, in a single year. How can one possibly keep up? Will this be a new plateau? Absolutely not. As Reed Hastings put it – "expect the content budget to keep going up in both 2019 and 2020". Now, if Netflix continues to grow its subscriber base at ~20% (slower than current rate, but still a tall ask) for the next 5 years, it will have added ~200 Million new subscribers by 2023/4. If the ASP grows to $12.5/mo (currently $9.78), they’d have generated ~$175 Bil in revenues in 2018-23 period and suddenly the content spend (even if it increases to ~$12B/yr) at ~$62B (5-year period) doesn’t seem as much. Picture source: Imagination, assumptions, and an Excel model But…not everything scales up as effortlessly as the multiplying mere numbers on a calculator. At some point, it will become difficult for people to consume more content than the viewing hours they have and the return on any additional content will start to diminish. I’m sure data buffs at Netflix are all over it and with how much they know about their subscribers, they’re probably laughing at this piece now (if they’re reading), but the point of this post is to highlight the fact that Netflix – as a product – has to evolve – rather quickly, if it wants to be a larger part of a subscribers’ routine and wishes to keep delaying the eventual saturation. I haven’t seen Netflix – as a product, evolve as much over the years, and while I believe their product teams might be on it, this post highlights three changes that I’d like to see. These will boost engagement hours and enable more returns on content spend that has already taken place. Over time, these will enable Netflix to become a more central part of users’ lifestyle and thus strengthen its moat. To be clear, these aren’t ambitious long-term ideas (like streaming eSports and News, or starting Disney-like theme parks centered around their original content), but things that I believe, Netflix could implement right away – 1. Giving Subscribers more control When I subscribed to Netflix (must be 2014) and signed in for the first time, I felt like a kid in the candy-land. I had a small appetite (number of hours I could watch), but I liked every candy in town and was afraid to lose any gem I came across. What did I do – added them to ‘My List’. Some days in, I stopped browsing for more content. I’d start my session by logging in and going to ‘My List’ and browsed it till I settled on something. Many evolutionary phases later, I have settled at a different plateau. It’s called ‘Just watch it already’. Over months and years, my list has become a library in itself – full of various formats, themes, languages, watch times, and moods – one which I have no control over…even my local free library has different halls for different subjects, but no, not my Netflix library – there’s no way to compartmentalize it. I’d often have to keep pushing the right button on the remote and go through all the titles, one-by-one, doing a ‘No-No-Maybe-No’ in my mind. This would take up some 10-20ish minutes and I’d feel even more confused with having considered titles I wasn’t in the mood for. Eventually I’d just go down to the ‘New on Netflix’ or ‘Trending Now’ rows to pick something quick and settle. Thus the name, ‘Just Watch it Already’. Picture Source: Netflix Netflix is a data company. The reason it can come up with attention-seeking and interest-retaining content is because it knows how you inherently react to – a scary scene, a reveal, a plot-twist, anything. It has pyramids of data about you and your watching behavior, which is the bed-rock of its decision making. As a data company, why wouldn’t you let the consumers get a taste of your capabilities? I think it’s a wasted opportunity of uniquely standing out. I’d like ‘My List’ to be sortable, groupable, filterable, anything-able. If you look for a robotic vacuum on Amazon (or anything basically), you can filter by manufacturer, $ range, size range, year of mfg, average ratings, etc etc – but on Netflix..you’re powerless. There isn’t even a way to filter for shows in your list, vs movies. If you just have 30 minutes before you have to leave, there’s no way of filtering ‘<30 mins/episode’ content. And I can go on and on…basically there’s no optionality to customize. I like how Spotify not only offers you mood-based suggestions, but also capability of creating your own playlists. Everybody’s Spotify account feels personal to them. There’s no way to personalize your Netflix (in terms of organization). Think of Netflix as a mall or a ware-house. At this pace of inventory (content) adds, the shelf-space and sorting robotic algorithms needs to evolve and expand quickly – for everyone to create their own mini-store they like to visit/come home to. Nobody likes to get lost in a warehouse full of stuff they’d never consume. I’d thus like Netflix to allow atleast filtering, sorting and grouping options by qualitative (content type, category, mood, genre, country of origin, etc) and quantitative (Run time, User ratings, awards won, pace of plot, etc) categories that it already has enough data about – a reason I believe this can be done right away. Summary: Share the power of data to let user have more control – they’ll make their account their own and will consume more. 2. All-in-one content hub: Trailers, IMDB ratings, a social networkI log-in to Netflix and see tens of new suggestions I’ve never heard about. I like how a couple of them feel (even if it’s just because of the graphic design of the title), but I don’t know anything about the nature or quality of content – so.. I open a few tabs, primarily IMDB and Youtube. I search for the movie/show name – read the lead review, critic ratings, cast, and other things. I hop onto Youtube or stay there to watch the trailer..not quite convinced if I want to watch that title..I come back to Netflix’s screen, pick the next title and start the tabbing-loop again….. …..that’s me almost every time when I feel like I have some time to spare to get to new content. Just like in scenario in #1, it leaves the viewer confused and lost – and that’s not good for anyone. If all that you’re about is entertainment content, why not provide more information about your product? I’d like Netflix’s title-summary screen (whenever you click on a title), to look something like..as a picture is worth a thousand words, I thought of sketching it up : Picture source: Self-created, not to be duplicated/implemented without permission. It explains my vision of having 3 things in one: 1. Current Netflix Screen + 2. Pre-view analytics (IMDB Ratings, Trailer, select critic review) + 3. Social Network capabilities (Friend circle rating, ability to view which of your friends have recommended it + option to start a ‘watch together’ session). I know you’re thinking .. where does the social network stuff come in? I don’t see why not. Even in the age of better-than-ever-before recommendation engines, it’s still strange that some of the better recommendations I end up watching are those recommended by my friends who know me better than what I’ve told them about me (who we are, are a greater than sum of the parts and bits of data we give out about ourselves..our human friends can add a judgement call to even sum up who we are and what we’d like..but then maybe AI got this covered soon, till then..), why not let them recommend me? Privacy concerns? ‘Friend-circle rating’ will be summary-level only (you won’t be able to see which friend rated what to a particular title), but you/your friends can chose to ‘recommend publicly’ a title you like. As the name has ‘publicly’ in it, it’ll be clear that you’d show up in your friend’s title-screen as the person who has liked that content. I believe knowing what your circle thinks about a title and their recommendations (without asking personally) would be insightful, regardless of you choosing to take it as a ‘to-watch’/’Never watching that’ cue. The idea of becoming a social platform has allured everyone from Google to Microsoft – but it has been difficult to succeed. Companies have gone out of their way to try/start a trend (Paypal trying to social-ize what you spend on, through Venmo), but while I feel Netflix is such a natural fit to be a social center (where you can rate, recommend, and watch movies together (virtually, while chatting to each other through text/video). If you think about Facebook as a social platform centered around posts, Instagram as one centered around pictures, we really don’t have one centered around video (Youtube isn’t social, Snapchat is limited at 15 second clips) – Netflix, through friend ratings, publicly recommend, and watch together, can become the first true social network centered around video entertainment. I’m sure the company has been long aware of the opportunity and has strategically chosen not to stay away. It’s still surprising though. Summary: Be an all-in-one content hub for solving the problem of discovering, exploring, researching, socially watching, and recommending content. Don’t let them go anywhere else – even not on Facebook to tell their friends how much they liked it. 3. Netflix Audio/On-The-Go:Number of hours I watch Netflix/Youtube in a day: ~1 Number of hours I listen to audiobooks/podcasts in a day: ~2 Yes, it varies by the day and yes, it’ll be different for everyone. But there’s no denying the trend that the world is moving to audio and the audio market is vastly understated. On an average, consumers watch 4 hours of video/day and listen to 3 hours audio/day (even with much less of high-quality original content). Even then, the video market is valued now at roughly a ~trillion dollars, whereas audio industry (Music+Radio+Podcasts) are valued collectively at ~$100 B (smaller than Netflix itself). As Spotify CEO Daniel Ek put it, “Are your eyes really worth 10 times than your ears?”. I believe the audio market will explode in years to come – not only in market value, but in consumption, as more and more authentic and high-quality audio content comes to market. It’s just more convenient to listen to something at all times, vs watching something – it should at least carve out more attention, in terms of duration of consumption. To meet this demand, while Spotify and Sirius XM are establishing their foundations, Netflix is lagging. Coming back – It’s almost impossible to keep up with even one genre of original content that Netflix is hitting you with, every single year. While there’s no need as such for you to ‘keep up’, you don’t want to miss out on the stuff you might like either. Way to try out more content is – for it to have more time of your day, and with no major lifestyle change (i.e. sacrificing sleep time further), audio seems the way out to me. Not everything needs to be ‘watched’ anyway. For example, I’m a big comedy fan and as we know, Netflix has been betting big on stand-up originals for the last couple years. I’d like to listen to many of them, but just can’t. ‘My list’ is full of stand up originals I’d like to listen to, but I just won’t have enough time. Notice that I said the word ‘listen’ above. It’s always better to watch a stand-up, but you don’t necessarily have to. There’s a lot of content that can qualify as audio-friendly, and I’d like Netflix to offer an audio solution in their mobile app (which will also have higher usage with this + social features). They can even charge a $3/5 extra in monthly subscription and I’m sure not many will blink an eyelid. Plus, at $3 or 5/month, many new users could be welcomed into the loop of Netflix originals and can then hop onto the video subscription- which is a minimal acquisition cost route to acquire new users and also provides an unparalleled omni-channel (or can we say multi-sense) experience. I believe with audio data available, this is something Netflix can do right away – we haven’t even talked about Netflix being a pioneer in creating original audio content (which is much cheaper to produce than video) and become a one true audio-visual entertainment company. Summary: Better leverage the content investments (~$8B/yr) by having a larger share of consumers’ time and data, by simply adding an audio option to the subscription. Do you wish to see Netflix applying these ideas too? Please share the post to spread the word :) Do you have other ideas of things you'd like to see? Comment on and let's develop a proposal! If you'd like to stay updated with my content.. Subscribe below or follow me on LinkedIn. --- Announcement 1: If you've been meaning to start fractional investing, here's a link to Robinhood. If you use this link, we will both get a free stock + I'll answer any questions you may have (on IG). Link: https://join.robinhood.com/sunnyg --- Announcement 2: I do #TipTuesdays on my Instagram where every Tuesday evening, I give out a stock tip/investing best practice. For a limited time, I'm also answering ALL DMs. Slide into my DMs with any and all questions. Handle: @thesunnypoint Video version of this blog post can be viewed here: My Advice to Netflix

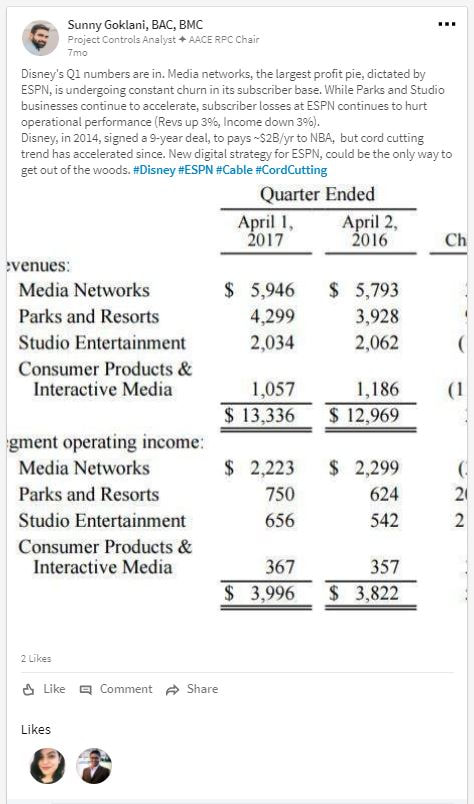

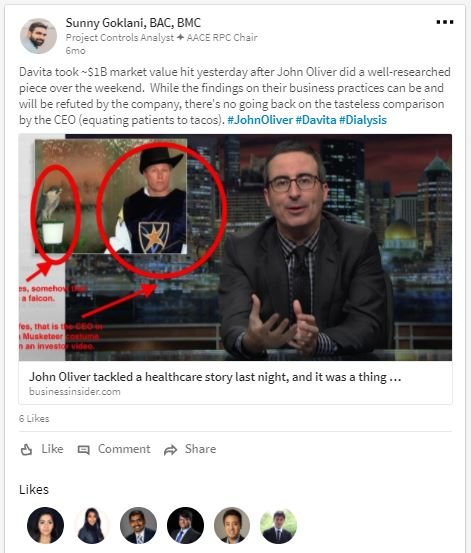

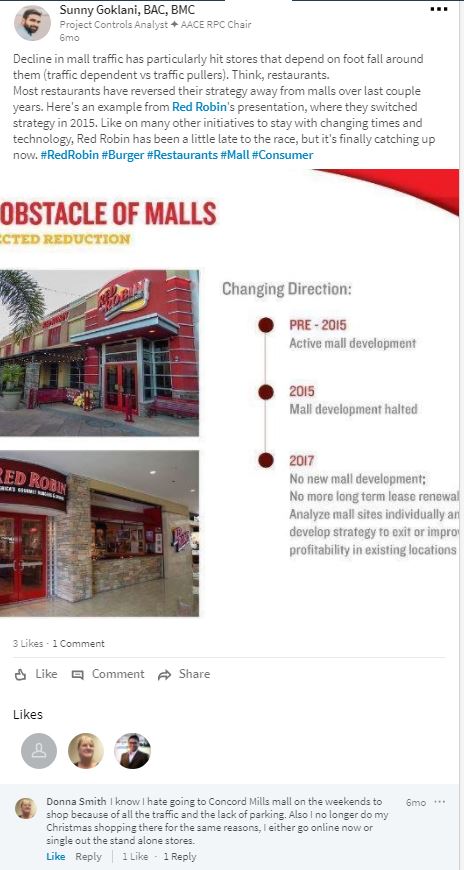

This blog post is compilation of LinkedIn posts that appeared in the months of April – June, 2017. Themes discussed are: April:

May:

June:

Posts Below : Clicking on pictures will take you to original posts on LinkedIn April 2017:

May 2017:

June 2017:

If you feel like adding to thoughts/debating/adding facts/opinion, I’ll be glad if you comment on the original posts (clicking the pictures will take you to the respective original post). If you feel like sharing the insights, I’ll be really glad if you share the blog posts or original posts on LinkedIn. Some points before you read posts:

:This blog post is compilation of LinkedIn posts that I authored from January - March 2017. Themes discussed are: January:

Posts Below : |

Brave BullTells you what the Mr. Market is missing. Archives

January 2022

Categories |

RSS Feed

RSS Feed