Summary

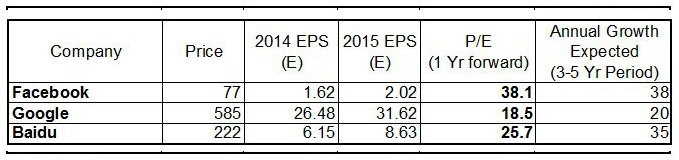

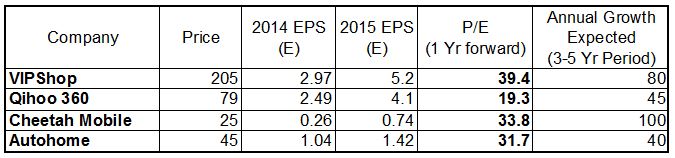

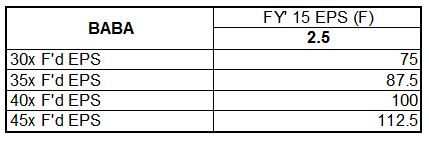

The countdown is in its final stages as Alibaba (BABA), the largest IPO ever in US history lists on the NYSE in less than 24 hours from now. The entire investment community has been discussing background of the company since long. We will thus skip that part and get down to the most pressing question on the mind of a retail investor: What is Alibaba worth? Should I buy it on the opening day? Let's try to answer this question by rationally estimating the valuation it deserves: Comparison with Peers: 1. At first thought, as Alibaba is an e-commerce leader, it appears as if it should be compared to Amazon (AMZN) & E-bay (EBAY). However, the sky-high valuation of Amazon and comparatively miniscule scale of e-bay render the comparison meaningless. Further, the China demographics and growth patterns are a totally different game to handle. All in all, this won't be a valid comparison. 2. Fast-Growing Internet companies: In the age of smartphone usage driving revenues across businesses, it seems fair to compare Alibaba to other global fast-growing internet peers: Namely Facebook (FB), Google (GOOG), Baidu (BIDU), etc. Following table compares the forward P/E ratio that Alibaba could take a cue from: Source: Yahoo Finance and MarketWatch forecasts Key Take-aways: - While Google is trading at an attractive valuation of less than 20x forward, it's 3-5 year growth rate is also supposed to be between late teens and early twenties. - Facebook, which is projected to grow earnings over annual rate of ~35-40% every year for 3-5 years to come, is trading at 38x forward. 3. Chinese fast-growing companies: We have seen Chinese IPOs all over the place in last couple of years. Many of them have generated great returns ( Tencent (TCEHY) & Vipshop (VIPS) for example), driven by explosive growth in internet-based industries in China. Investors generally do not prefer to allot more than a certain percentage of their portfolios on speculative plays, and thus would like to re-arrange their Chinese holdings. That makes it crucial for Alibaba to be compared to some of its fast-growing Chinese peers. Following table compares some of the profitable ones (Refer Table 2). Source: Yahoo Finance and MarketWatch forecasts Take-Away: - While stocks like Qihoo 360 appear attractive after recent pullback, many high-growth Chinese stocks are trading in 30-40x forward earnings. What to do tomorrow: Alibaba's 2014 EPS stands at $1.71. According to the consensus estimates, it will have FY15 EPS in the range of $2.4-2.6. For our calculations, let's take the average at $2.5. At the issue price of $68 (most probable), it will be trading at 40x 14 earnings and 27.2x forward earnings - which is indeed a bargain. However, there are almost negligible chances of getting the stock at that price tomorrow. The stock is slated to open higher, but the extent of the gap will drive the decision of buying in or staying away. Presented are various scenarios, based on multiples of forward earnings: (Refer Table - 3) Verdict: With other smaller and lesser known Chinese growth stocks demanding 30-35x forward, Alibaba certainly deserves at least 30x valuation, which takes us to $75. A strong market share and profitable business model makes it further deserve higher than average multiples. However, with the corporate structure risks in place, I would suggest staying in the range of 35-40x range: i.e. if you are in for the short or medium term, I will not suggest getting in at the higher end of the range. While it is possible that the market frenzy drives the stock beyond the $100+ mark, I would prefer having 10% margin of safety (~3-4% of the range). Thus, if the stock opens in 70s or 80s, I suggest it should be bought with its fair value in the range of $87.5-100. Further, I would suggest short term traders to book profits if it rises above $100. However, long term investors can hold on as holding Alibaba's stock could be one of the best ways to play the China's growth story. Disclosure: - The author has no positions in any stocks mentioned, but may initiate a long position in BABA over the next 72 hours. - The author wrote this article themselves, and it expresses their own opinions. Any form of sharing of this article should require Author's permission. - The author has no business relationship with any company whose stock is mentioned in this article.

1 Comment

|

The Brave bullSunny Goklani, (under this pen name) is a High-Growth investor, hungry for value. ArchivesCategories

All

AuthorWrite something about yourself. No need to be fancy, just an overview. |

RSS Feed

RSS Feed