|

2023 was one of the few years when the majority of forecasters predicted a recession and stocks spiraling down - but against all odds, economy remained resilient and markets soared. S&P 500, coming off a rough 2022, surged 25%, and the Nasdaq? A whopping 45%. The recession? Still lost in the forecast files. Here are 3 key themes that made it so:

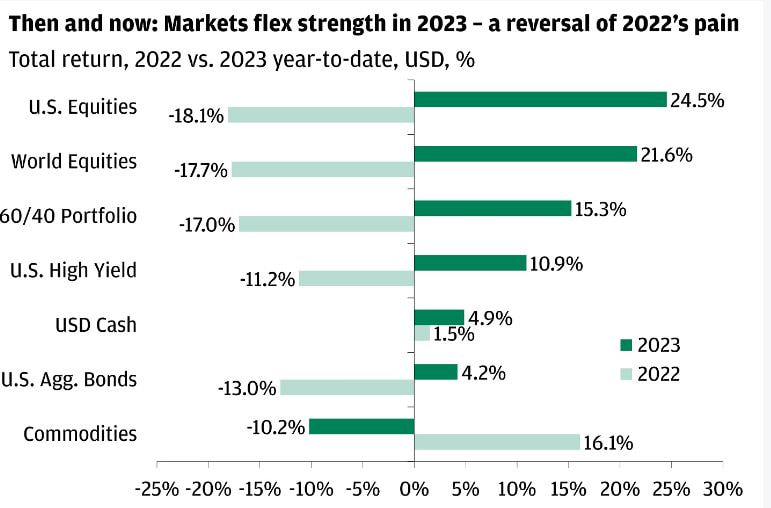

1. The Art of Soft Landing: Some called him reckless, others a magician. “Could Jerome Powell pull off a historic soft landing?” was the question - and he did indeed. Amidst doubts, he managed to land the economy, softly. An impressive feat. Inflation cooled slowly but surely - from a peak of 9.1% in Jun 2022 to 3% by 2023 end. Higher interest rates, easing supply chains, and lower commodity prices all played their part in taming the beast. 2. The Resilience Rewrite: Textbook rewrites are in order: Rising interest rates, the textbook harbinger of economic woes, didn't bring the predicted carnage. Housing prices, instead of collapsing, stabilized or even climbed. Automobile demand did not fall (rather up 10%+). The unemployment rate stayed near record lows (~3.6%). Reason? While we were worried about demand slump, we realized how short we still are on supply: in housing, mfg., and labor. Consumer spending defied expectations, climbing steadily alongside confidence (from <90 to a buoyant 110). Travel spending also continued its ascent, collectively boosting the Consumer Discretionary sector by an impressive 40%. Even the collapse of 5 mid-major banks and crypto platforms did not faze the market - larger players swooped in, took market share, and contained the damage. 3. The AI Boom Takes Flight: While the soft landing was still a question mark, stocks surged in early 2023, thanks to one revolutionary force: AI. OpenAI got a $10B investment from Microsoft in Jan (28x jump in valuation). NVIDIA posted a monster quarter (driven by the H-100 chip) in May – and jumped 25% overnight to join the $1T club. Tech giants (Google Meta Amazon Apple), in a frenzy of AI innovation, saw their collective market cap surge by a staggering $2.4 trillion. IT and Communication Services sectors soared, propelled by the AI windfalls, clocking in gains of 56% and 54%, respectively. The startup scene saw a new dawn – between OpenAI, Databricks, CoreWeave, Inflection AI, Anthropic AI, Starlink AI, Metropolis Technologies, Runway ML, SandboxAQ, etc. – a rush of capital flooded the market chasing AI TAMs. ... 2023 was truly a year for the history books. But what's in store for 2024? What will the AI disruption look like? Which sectors will lead or lag in the market cap addition/disruption metrics? Will inflation rear its ugly head again? Drop your predictions in the comments below, and stay tuned for upcoming posts, where I'll delve into the potential disruptions and dynamics shaping the coming year. ... Picture Credit: JPM Research

0 Comments

Leave a Reply. |

Author noteSunny is a published market commentator. All takes are his own and not financial advice. ArchivesCategories |

RSS Feed

RSS Feed