|

26 days into 2024, Netflix is up 22% year-to-date, while Tesla is down 26%. While various factors contribute to both performances (TKO deal, interest rates, etc.), I believe the divergence ultimately boils down to a shift in assessment of pricing power:

✧ Netflix: ▪ Strong Product & Strategic Pricing: Despite the password crackdown, Netflix's content proved valuable enough for users to create new accounts (13 million subscriber additions in Q4 alone). Additionally, introducing an entry-level tier not only widened the customer base but also: - Increased prices at higher tiers, and - Paved the way for future price hikes at the entry level. ▪ Investor Reassessment: This well-executed strategy, coupled with consistent user growth, led investors to recognize their underestimation of Netflix's competitive advantage and, consequently, its pricing power. ✧ Tesla: ▪ Demand vs. Supply Narrative: Traditionally, Tesla presented itself as a supply-constrained growth story, not demand-constrained, implying limitless demand and 50% annual production growth. Reconsideration: ▪ Price & Target Cuts: Reductions across the product portfolio in H2 2023 has been unsettling investors. This week's news of lowered production targets further spooked them (“If demand is endless, why would you make less and sell the product even cheaper?”. Maybe Model 3 and Y market saturation occurred earlier than anticipated? On the earnings call, Musk's cited higher interest rates necessitating price cuts and production adjustments - hinting at potential demand limitations. ▪ Investor Reassessment: This series of realities prompted investors to re-evaluate their previous overestimation of Tesla's competitive position and, consequently, its pricing power. ❏ Bottom Line: While TAMs (Total Addressable Markets) are easily claimed, a company's true moat is reflected in its customer's willingness to pay a premium, reflecting its pricing power. As an investor, a lot of your skill lies in judging if the market is undermining or exaggerating it. How do your investments fare? Share in comments below or on socials!

0 Comments

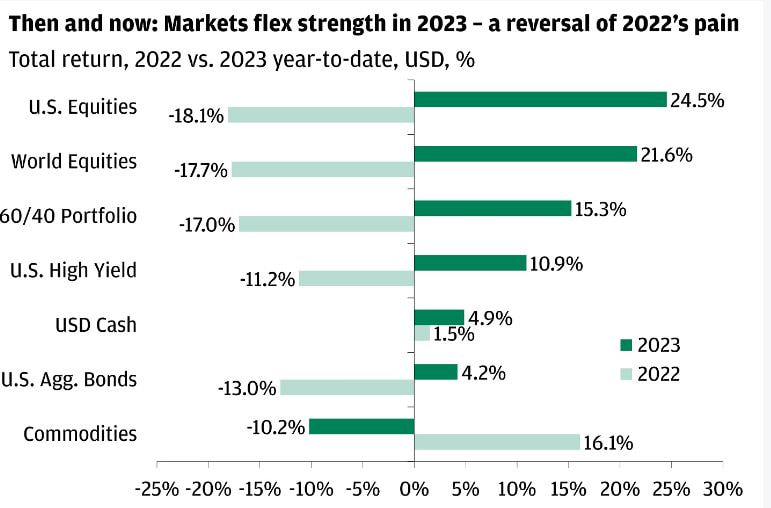

We looked back at summarizing 2023 in the last one..here's one with 3 Predictions (each) for Markets and AI for 2024: ✦ Markets: 1. Interest Rate Plateau, Not Plunge: S&P 500 rose ~14% in last 2 months of 2023. This ride up was driven by the realization that soft landing has happened. While 6 Fed cuts are now priced in, I predict Fed won't be as aggressive. Barring a sudden downturn, nominal rates will plateau in the 3.5-4.5% range, even with sub-3% inflation. Expect some market bumps as expectations adjust, but with that said.. 2. Markets post a decent year (Up 5-10%): Valuations aren’t cheap right now, but a goldilocks economy can sustain valuations higher – the rise in prices will just bank more on the earnings part of the equation. (More on specific sector/co. predictions separately). Fundstrat Global Advisors’ Tom Lee points out how since 1937, the highest P/E is realized when yields are b/n 3.5% and 5.5%. When between 4% to 5%, P/E is >18X 65% of the instances. 3. Commodities will find footing or do better: After sharp declines in 2023, a soft-landing scenario should stabilize commodities. Energy and base metals, along with related equities (think XLE), are poised for a better year. This is related to how inflation may keep Fed anxious => slower rate cuts. ✦ AI: 1. Value Migration: Beyond the Hype Machine: 2023 was the year of AI boom – valuations were mostly snatched up by startups, semiconductor designers, and big tech. While that will continue (no signs of a bubble yet), 2024 will mark a shift: value will start diffusing across sectors, with early adopters within industries taking center stage. Think of how internet start ups snatched most value during the dot com bubble, but over time other sectors gained an internet-first premium or a sense of irrelevance based on adoption (the difference for example for a retailer becoming truly omnichannel vs going out of business). Proprietary use cases and specialized models will be the winning hand. 2. Hardware will get an AI boost: Access to powerful AI is about to get easier. On-device AI processing chips will be integrated into phones, laptops, and desktops, making AI more accessible and user-friendly. New devices will feature dedicated AI launch buttons, revitalizing the hardware industry while simplifying user onboarding. 3. Beyond Words: The Multimodal Revolution: Comprehension of LLMs is still pretty limited. It can read and generate text – but human comprehension goes much beyond that. 2024 will bring the rise of the multimodal LLM, capable of understanding and generating across image, video, and mixed media. You could feed anything and expect everything, and vica-versa. Use cases will explode accordingly. -- What do you agree/disagree with? What are your top predictions for 2024? Chime in here or on socials.. 2023 was one of the few years when the majority of forecasters predicted a recession and stocks spiraling down - but against all odds, economy remained resilient and markets soared. S&P 500, coming off a rough 2022, surged 25%, and the Nasdaq? A whopping 45%. The recession? Still lost in the forecast files. Here are 3 key themes that made it so:

1. The Art of Soft Landing: Some called him reckless, others a magician. “Could Jerome Powell pull off a historic soft landing?” was the question - and he did indeed. Amidst doubts, he managed to land the economy, softly. An impressive feat. Inflation cooled slowly but surely - from a peak of 9.1% in Jun 2022 to 3% by 2023 end. Higher interest rates, easing supply chains, and lower commodity prices all played their part in taming the beast. 2. The Resilience Rewrite: Textbook rewrites are in order: Rising interest rates, the textbook harbinger of economic woes, didn't bring the predicted carnage. Housing prices, instead of collapsing, stabilized or even climbed. Automobile demand did not fall (rather up 10%+). The unemployment rate stayed near record lows (~3.6%). Reason? While we were worried about demand slump, we realized how short we still are on supply: in housing, mfg., and labor. Consumer spending defied expectations, climbing steadily alongside confidence (from <90 to a buoyant 110). Travel spending also continued its ascent, collectively boosting the Consumer Discretionary sector by an impressive 40%. Even the collapse of 5 mid-major banks and crypto platforms did not faze the market - larger players swooped in, took market share, and contained the damage. 3. The AI Boom Takes Flight: While the soft landing was still a question mark, stocks surged in early 2023, thanks to one revolutionary force: AI. OpenAI got a $10B investment from Microsoft in Jan (28x jump in valuation). NVIDIA posted a monster quarter (driven by the H-100 chip) in May – and jumped 25% overnight to join the $1T club. Tech giants (Google Meta Amazon Apple), in a frenzy of AI innovation, saw their collective market cap surge by a staggering $2.4 trillion. IT and Communication Services sectors soared, propelled by the AI windfalls, clocking in gains of 56% and 54%, respectively. The startup scene saw a new dawn – between OpenAI, Databricks, CoreWeave, Inflection AI, Anthropic AI, Starlink AI, Metropolis Technologies, Runway ML, SandboxAQ, etc. – a rush of capital flooded the market chasing AI TAMs. ... 2023 was truly a year for the history books. But what's in store for 2024? What will the AI disruption look like? Which sectors will lead or lag in the market cap addition/disruption metrics? Will inflation rear its ugly head again? Drop your predictions in the comments below, and stay tuned for upcoming posts, where I'll delve into the potential disruptions and dynamics shaping the coming year. ... Picture Credit: JPM Research |

Author noteSunny is a published market commentator. All takes are his own and not financial advice. ArchivesCategories |

RSS Feed

RSS Feed